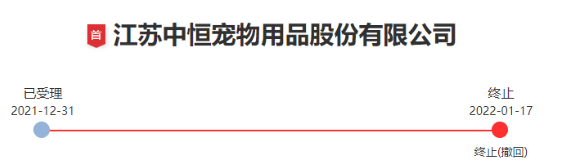

On January 17, the status of Jiangsu Zhongheng Pet Products Co., Ltd. (hereinafter referred to as "Zhongheng Pet") on the GEM issuance and listing review information disclosure website was changed to "terminated". On the same day, documents released by the Shenzhen Stock Exchange showed that because Zhongheng Pet and its sponsor Essence Securities submitted an application to withdraw the company’s listing application documents on January 13, 2022, the Shenzhen Stock Exchange terminated the listing of Zhongheng Pet on the GEM in accordance with regulations. review. Judging from the timeline, Zhongheng Pet’s IPO application was accepted on December 31, 2021, and only 13 days later, the company withdrew its application.

Zhongheng Pet specializes in pet products. Its main products include pet changing pads, cleaning bags and other pet hygiene and cleaning products, as well as pet home furnishings such as pet cages and feeding and watering equipment. Leisure Products. From 2018 to the first half of 2021, the company recorded operating income of 855 million yuan, 962 million yuan, 1.068 billion yuan, and 550 million yuan respectively; the net profits attributable to the parent company were -2.522 million yuan, 34.1928 million yuan, 94.266 million yuan, and 35.4855 million yuan respectively. Ten thousand yuan.

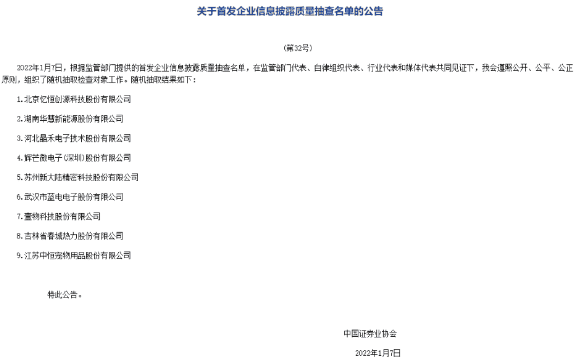

It is worth noting that the time point for Zhongheng Pet to withdraw its listing application was just after the company was selected to enter the first batch of on-site companies in 2022. On January 7, the Securities Association of China issued the "Announcement on the List of Random Inspections on the Quality of Information Disclosure of IPO Companies" and Zhongheng Pet was among them.

At the beginning of 2021, there was a large-scale withdrawal of companies selected for on-site inspections. On January 31, 2021, an announcement issued by the Securities Association of China showed that a total of 20 companies were selected for on-site inspection on the Science and Technology Innovation Board and the GEM, including 9 companies on the Science and Technology Innovation Board and 11 on the GEM. Within 10 working days after the list was released, 7 companies on the Science and Technology Innovation Board withdrew their IPO applications, and 9 companies on the GEM withdrew their applications. In response to these situations, the Shanghai and Shenzhen Stock Exchanges also answered reporters’ questions in February 2021. According to the Securities Times, at that time the Shanghai and Shenzhen Stock Exchanges stated that “the regulatory linkage mechanism of on-site inspections, on-site supervision and review inquiries must be fully utilized, and strict Close the entrance to listing. For projects withdrawn before on-site inspection, if suspected financial fraud, false statements and other major violations of laws and regulations are found, the sponsor and issuer must bear corresponding responsibilities and must not be withdrawn immediately. "No matter what, we will never allow you to enter the border while sick."

The withdrawal of Zhongheng Pets may also be related to the on-site inspection of being selected, but judging from the signals previously released by the Shanghai and Shenzhen Stock Exchanges. , if major violations of laws and regulations are discovered after withdrawal, the company and the sponsoring institution will not be able to escape responsibility.

Judging from Zhongheng Pet’s prospectus, the company has made special reminders on major risk factors. For example, the company’s sales revenue to U.S. customers from 2018 to the first half of 2021 accounted for the proportion of its main business revenue respectively. were 83.91%, 85.04%, 84.72% and 81.16%. Related businesses have been affected by the Sino-US trade friction. During the same period, the company's main business gross profit margins were 14.41%, 22.08%, 22.94% and 18.79% respectively, showing certain fluctuations, affected by The macroeconomic situation, international trade situation, changes in raw material prices and other factors may affect the future gross profit margin and may cause adverse changes; in addition, the company's gross profit margin decline in the first half of 2021 may also lead to a decline in performance in 2021.

From the perspective of the pet economy industry, the recent financial data and stock price performance of the A-share listed companies involved are not ideal. Among them, the revenue of Petty Holdings (300673.SZ), which is mainly engaged in pet food, fell by nearly 6% year-on-year in the first three quarters of 2021, and the net profit attributable to the parent company fell by about 5%; during the same period, although the revenue of China Pet Holdings (002891.SZ) A year-on-year increase of 24%, but the net profit attributable to the parent company also fell by nearly 5% year-on-year; Yiyi Shares (001206.SZ) revenue did not change much, and the net profit attributable to the parent company fell by nearly 40% year-on-year. From the opening on July 1, 2021 to the closing on January 18, 2022, Petty shares fell by 19.14%, Zhongchong shares fell by 31.71%, and Yiyi shares have continued to fall since the high point on May 26, 2021. At present, The stock price has been cut in half, and the transaction volume has shrunk from over 1.6 billion yuan at its peak to less than 50 million yuan.

Pet economy companies have lost favor in A-shares. However, what is even worse is that Zhongheng Pet’s financial data performance is not as good as the above three comparable companies. In 2020, the average operating income of the above three companies was 1.604 billion yuan, the average net profit attributable to the parent company was 148 million yuan, and the average comprehensive gross profit margin was 25.42%. In the same year, these three data of Zhongheng Pet were only 1.068 billion yuan and 94.266 million yuan respectively. ,23.18%.

After being selected for on-site inspection and then withdrawn, the company’s industry status is not outstanding, and the recent performance of listed companies in the same industry is unsatisfactory. From acceptance to termination, Zhongheng Pet’s IPO process in less than 20 days was like a dream. .

扫一扫微信交流

扫一扫微信交流

发布评论