On February 16, 2023, Nestlé announced its 2022 full-year financial report. In the year to December 31, 2022, Nestlé’s total revenue was CHF 94.4 billion, a year-on-year increase of 8.3%.

It is worth noting that Nestlé’s Purina Petcare business will have revenue of 18.1 billion Swiss francs in 2022, accounting for 19.2% of total revenue and a year-on-year growth of 16.4%. The "biggest contributor" to the group's total revenue growth.

On February 24, 2023, at the Consumer Analyst Group Symposium in New York (CAGNY), Nestlé Chief Financial Officer Francois-Xavier Roger delivered a speech specifically on Purina’s performance and shared the future of Purina. Rena's development plan.

Purina has undoubtedly become one of Nestlé's key businesses. Combining Purina's financial data and its brand actions in 2022, Brand Planet has compiled the following key information and shares it with you through this article:

Having maintained double-digit growth for two consecutive years, Purina has become Nestlé's second largest main business

Roger mentioned in his speech at CAGNY that Purina has maintained growth since it was acquired by Nestlé in 2001.

From 2002 to 2016, Purina's average organic growth rate was 6.2%; since 2017, its growth rate has begun to accelerate, and will maintain its growth rate for two consecutive years from 2021 to 2022. Double-digit growth.

Purina’s average organic growth rate from 2002 to 2022

In addition to the characteristics of fast growth, Purina’s proportion of total revenue is also gradually increasing , growing from 15% in 2019 to 19.2% in 2022, becoming Nestlé's second largest main business in addition to solid and liquid beverages.

Nestlé’s revenue by category in 2022

At the same time, Purina’s profits are considerable. Purina's profitability exceeded 20% in 2022, Roger said. This also means that the pet care business has the potential to increase Nestlé’s overall profit margin, and may surpass solid and liquid beverages in the future to become Nestlé’s largest main business.

It already has 6 "billion brands" and will focus on high-end pet food in the future

Currently, Purina has 26 brands, of which 6 brands have revenue More than one billion Swiss francs, mainly concentrated in pet staple food categories (cat, dog dry food and cat wet food).

Purina’s “Billion Brands” Matrix

Among them, Purina PRO PLAN (domestic name is “Guanneng PROPLAN”) and Purina ONE, which rank top two in terms of revenue, are both It is a "rising star" that only joined the billion-dollar brand queue in 2018, and has maintained a strong growth momentum.

The rapid growth may be related to the differentiated brand positioning of the above two brands as high-end and ultra-high-end. Roger shared an interesting data in his speech: the average growth rate of Purina's high-end products is 2.3 times that of other products. Precisely because it is optimistic about the prospects of high-end pet food, Purina has increased its investment in research and development of high-end products. Currently, 60% of its investment portfolio value belongs to the high-end market.

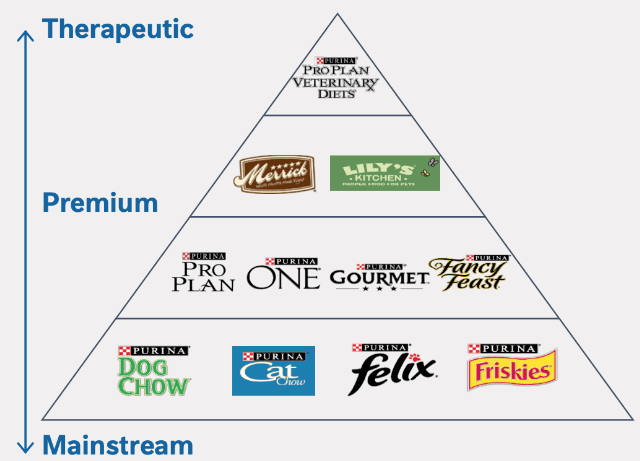

According to different positioning, Purina also categorizes its brands into three levels: therapeutic (Therapeutic) brand, high-end (Premium) brand and mainstream (Mainstream) brand.

Purina’s current brand hierarchy

You can see the mainstream brands at the bottom of the pyramid, most of which are pet snack brands. Roger said that this segment will not be the focus of Purina's R&D investment in the future. In the future, its R&D focus will still be high-end pet staple food based on scientific research. At the same time, emerging subdivisions, such as fresh pet food and pet nutritional supplements, are also the product expansion directions Purina is currently exploring.

China is an emerging market that Purina focuses on developing

Brand Planet has noticed that Purina has adjusted its Chinese product strategy in recent years. On the one hand, it has expanded its domestic veterinary product line ( Prescription food) layout, on the other hand, it is also actively introducing new functional pet food products from overseas.

In October 2020, Purina launched the first batch of Crown Energy prescription food in China, launching 4 types of prescription dry food for cats and dogs. In the past year, Purina has successively launched the new "Guanneng Adult Cat Kidney Care Full-price Prescription Food" and "Guanneng Cat Gastrointestinal Care Full-price Prescription Food" for the care of cats with chronic kidney disease and gastrointestinal diseases. Improve the prescription food product matrix. Currently, Purina has launched 7 prescription food products.

Purina's GN Prescription Food

In May 2022, Purina also introduced the "GN LiveClear Series" functional cat food from overseas, focusing on reducing Active allergens on the cat's body surface, thereby reducing the risk of people being allergic to cat hair.

GN LiveClear Soothing Series

In addition, as early as 2021, Purina invested in and built a factory in China to increase China's local prescription grain production capacity. In March 2021, Purina launched a two-phase investment project for high-end pet dry food and high-end pet wet food production lines in Tianjin, with a scale of 830 million yuan. The Tianjin factory has also become Purina's first in the Asia-Pacific Africa region and the fourth factory in the world with prescription grain production capacity.

In his speech, Roger also repeatedly mentioned the Chinese market and said that "huge opportunities come from Asia, more specifically from China."

Roger proposed the concept of "Calorific Coverage" to show the proportion of pet cats and dogs choosing pet food and other processed foods. As can be seen from the figure, the proportion of Calorific Coverage in developed countries is quite high. For emerging markets like China, the value of Calorific Coverage is only about half that of developed countries, while maintaining a relatively fast growth rate.

The proportion of Calorific Coverage in different markets

This also means that in emerging markets, the number of people feeding pet food is not only growing, but there is also considerable room for growth. Processed pet food still has a Huge market opportunity.

扫一扫微信交流

扫一扫微信交流

发布评论