1. Tianyuan Pet: A comprehensive pet product supplier of all categories, with solid performance in 2022

Tianyuan Pet is currently a comprehensive pet product supplier of all categories in China. The company’s business covers pet supplies. Design, production and sales links, as well as pet food sales business. The company's main products include pet nest mats, cat climbing frames, pet food, pet toys, pet clothing, electronic supplies and other series and full categories of pet products. In terms of financial situation, Tianyuan Pets achieved revenue of 1.887 billion yuan in 2022, a year-on-year increase of 1.75%. The revenue growth rate has slowed down compared with the high growth in the past two years. In 2022, the company achieved a net profit attributable to the parent company of 129 million yuan, a year-on-year increase 19.75%. The profit side of the company maintained rapid growth, mainly benefiting from the year-on-year increase in exchange income. From a growth perspective, the company's revenue and net profit attributable to parent companies have compound annual growth rates of 18.4% and 20.0% respectively from 2014 to 2022, showing overall rapid long-term growth capabilities.

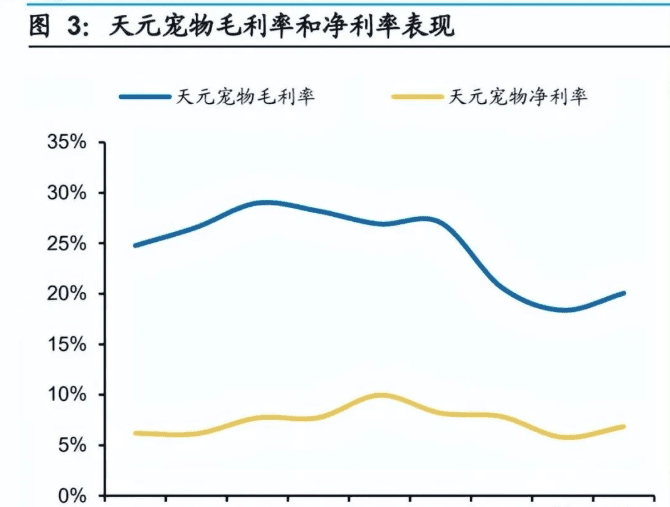

In terms of profitability, the company's overall gross profit margin and net profit margin performance are relatively stable. In 2022, the company will achieve a gross profit margin of 20.05%, a year-on-year increase of 1.7 percentage points. In terms of net interest rate, the company's net interest rate in 2022 was 6.9%, a year-on-year increase of 1.1 percentage points. The company's average gross profit margin and average net profit margin from 2014 to 2022 are 24.6% and 7.4% respectively. From the expense side, the company's sales/management/R&D/financial expense ratios in 2022 will be 7.2%/3.4%/1.0%/-0.9% respectively, up +1.0/ +0.4/ +0.0/ -2.0 pcts respectively year-on-year. Financial expenses The significant year-on-year decrease was mainly due to the increase in exchange income caused by the depreciation of the RMB. In 2022, the company achieved exchange income of 29.75 million yuan.

In a single quarter, the company achieved revenue and Net profits attributable to parent companies were 377 million yuan and 33.69 million yuan, respectively, a year-on-year decrease of 27.5% and an increase of 27.5%. The decline in the company's revenue in 22Q4 was mainly due to the weakening of overseas demand. It will take time for client inventory turnover to be digested. With overseas demand With the rebound, the company's overseas sales revenue is expected to improve. In 23Q1, the company's revenue was 427 million yuan, a year-on-year increase of 0.7%, and revenue growth has stabilized; in 23Q1, the company achieved net profit attributable to shareholders of 13.59 million yuan, a year-on-year decrease of 29.3%. In 23Q1, the company's gross profit margin and net profit margin were 16.8% and 3.2% respectively, down 2.1 and 1.3 percentage points respectively year-on-year. In terms of expenses, the company's sales/management/R&D/financial expense ratios in 23Q1 were 6.7%/3.5%/1.4%/1.3% respectively, up -0.2/-0.2/+0.4/+0.2%pcts respectively year-on-year.

2. Sub-products: In 2022, the food business increased significantly by 54% year-on-year, and the import of international pet food brands is expected to increase

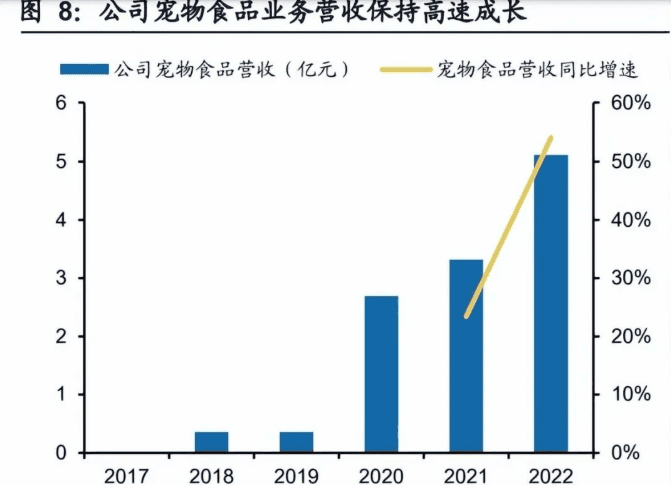

From the perspective of product structure, in 2022 the company’s pet products, pet food The food business achieved revenue of 1.349 billion yuan and 511 million yuan respectively, accounting for 71.5% and 27.1% of the total revenue of listed companies respectively. The share of pet food revenue in 2022 increased significantly by 9.2 percentage points year-on-year. In recent years, as the company actively develops pet food import business, the company's pet food revenue share has continued to increase. The proportion of pet food in its main business revenue has increased by 23.4 percentage points from 4.1% in 2018 to 27.5% in 2022.

(1) Pet food business: The pet food business increased by 54% year-on-year in 2022, and the gross profit margin rebounded

The company’s pet food business will achieve substantial growth in 2022, with revenue increasing by 54.01% year-on-year. to 511 million yuan, a year-on-year growth rate further accelerating from 23% in 2021. The company's food business is mainly authorized to sell international brand pet food products to the domestic market. The products are mainly staple food products for cats and dogs. Since 2020, the company's pet food business has achieved leapfrog growth. In 2020, the company began to mainly sell imported pet staple food. The company authorizes the sale of well-known international and domestic pet food brands such as Desire, Alcana, Mars, Nestlé, and McFoody, as well as Xinshidai's own brand products through cross-border imports and other methods. The pet food business has achieved rapid growth, with Mars, Nestle, etc. Such international brands are high-end pet food products, and there are certain product positioning differences with domestic pet food and snack companies. In the second half of 2021, the company adjusted its pet food suppliers for the Desire and Aiken brands and added general trade import channels. As a result, both cross-border import and general trade channels have been officially authorized by the brand owners. The company will begin selling branded pet food purchased through general trade import channels to Tmall Supermarket in 2022. In addition to the Desire and Aikena brands, during the reporting period, the company further developed the agency sales business of pet foods under its subsidiaries such as Surigao, Mars, and Nestlé. In the future, the company's cooperation with Nestlé will further deepen from product sales as an agent to operational cooperation and the opening of e-commerce flagship stores. Relying on the advantages of its own industrial location and supporting operation system, the company is expected to further develop its imported staple grain sales business.

The gross profit margin of the food business has fluctuated. In 2022, the company's pet food gross profit margin will be as high as 14.8%, a significant increase of 6.2 percentage points year-on-year. The company's relatively low pet food gross profit margin in 2021 is mainly due to exchange rate fluctuations. From January to June 2022, the company's pet food purchases and sales were all priced in U.S. dollars, and the impact of exchange rates on gross profit margins was eliminated. At the same time, after the company changed the supplier of Aspiration and Aikena brand pet food in the second half of 2021, the purchase price As a result, the company's pet food gross profit margin will increase significantly year-on-year in 2022.

(2) Pet products business: The company’s pet products business revenue declined in 2022

In 2022, the company’s pet products export business declined. In 2022, the company’s pet products business achieved sales. Revenue was 1.349 billion yuan, a year-on-year decrease of 9.78%, indicating a decrease in revenue. The company's pet products business has maintained rapid growth from 2014 to 2021, with the compound annual growth rate of revenue reaching 17.7%. In terms of gross profit margin, the gross profit margin of pet products business in 2022 was 21.68%, a year-on-year decrease of 2.73 percentage points. In terms of raw materials, the company's pet product raw materials mainly include fabrics, sheets, sisal, PP cotton, paper tubes and other production materials. From the cost structure of self-produced pet products, the cost of direct materials/labor expenses/manufacturing expenses accounted for 20% in 2022. The ratios are 50.1%/16.3%/17.8% respectively.

From the perspective of product segments, the product structure of the company's pet products is relatively diversified. Among them, the proportion structure of cat climbing frames/pet toys/pet nest mats/other products is relatively balanced, accounting for 2022 of the company's pet products. The business revenue ratios were 28.0%/22.8%/20.2%/29.0% respectively, a year-on-year increase of +1.1/-1.9/-3.6/+4.4 percentage points respectively.

From the perspective of the growth rate of product segments, the major revenue declines in 2022 were pet nest mats and pet toys, with revenue falling by 23.3% and 16.7% respectively year-on-year, while cat climbing frames and other pet products revenue decreased by 6.0% and increased by 6.1% respectively. Looking at the growth of subcategories, the revenue GAGR of cat climbing frames/other pet products/pet toys/pet nest mats from 2014 to 2021 were +22.9%/+17.5%/+16.5%/+14.5% respectively. In terms of gross profit margin, the gross profit margin of cat climbing frames/pet toys/pet nest mats/other pet products in 2022 will be 22.6%/23.5%/22.4%/18.8% respectively, which are -3.1/-1.9/-2.8/-2.4pcts respectively year-on-year. .

From the perspective of production model, the company's pet products production model is divided into three categories: self-produced products, outsourced products and outsourced products. According to the company's prospectus data, in the company's pet products business in 2021, self-produced, outsourced, and outsourced revenue accounted for 24.6%, 74.2%, and 1.2% respectively, with outsourcing accounting for more than 70%. The outsourcing model is the main source of revenue for pet products. This is mainly due to the large number of pet product product types and specifications and the large differences in materials and processes. The country has abundant supporting processing and manufacturing resources for light industrial products. Therefore, the company mainly relies on outsourcing processing and only relies on outsourcing. The company retains the production model of some of its own production lines for its core products, cat climbing frames and pet nest mats, in order to leverage its comparative advantages in division of labor in the industrial chain and focus on core business links with high added value such as product development and customer development services. From the perspective of subdivided categories, the company's self-produced products are mainly cat climbing frames and pet nest mats. In 2021, the company's self-produced revenue from the cat climbing frame and pet nest mat business accounted for 69.3% and 23.3% respectively, while other supplies and The proportion of pet toys outsourcing was 94.1% and 99.3% respectively.

3. Sub-region: pet food has opened up the domestic market, and the overseas Australian and North American markets are relatively stable

(1) Domestic business: exploration and development of diversified sales models and channels, imported pet food business Open up the situation

In 2022, Tianyuan Pet’s domestic main business revenue will be 673 million yuan, a year-on-year increase of 33.0%. The company’s domestic revenue has achieved a significant jump since 2020, mainly due to the company’s domestic pet food development business. Taking into account that pet food consumption is currently the main demand of my country's pet industry, the company adopts a domestic market operation strategy of food-driven supplies, taking the authorized cooperation to sell internationally renowned pet food brand products as a guide, and establishing and consolidating domestic online and offline sales channels. From the perspective of channels, Tianyuan Pets mainly sold products through offline channels such as dealers from 2017 to 2018. Since 2019, the company has developed online channels and established brand stores in Tmall, JD.com and Xiaomi Youpin. From 2020, Tianyuan Pet has added new customers through e-commerce channels such as Tmall overseas direct sales and Kaola, and its domestic revenue has achieved breakthrough growth.

(2) Overseas business: taking advantage of the stable overseas pet market Development trend, core overseas customers grow steadily

From a regional perspective, Tianyuan Pet’s current main revenue still comes from overseas business. Overseas business revenue accounted for 63.8% in 2022 and is still the company’s main source of income. Judging from the regional structure of overseas business, the proportion of revenue in North America/Europe/Oceania/Asia in 2011 accounted for 38%/28%/22%/10% of overseas revenue respectively.

4. Overseas customers: Core customers include Kmart AUS and Chewy. The top five customers accounted for 31.25% of sales in 2022.

The company started as an export OEM business for pet products. Overseas customers are mainly large chain retailers, professional pet product chain companies, and e-commerce companies. After long-term customer service and optimization, we have accumulated large customers including large supermarket chains such as Walmart, Kmart AUS, TRS, Birgma, and KOHNAN in the United States. Internationally renowned e-commerce companies such as Amazon and Chewy, as well as large pet supply chain companies such as Fressnapf and Petco, etc. From the perspective of customer concentration, the company's top five customers accounted for 31.25% of sales in 2022. The proportion of the five largest customers has declined in the past two years, falling from the highest of 36.1% in 2020 to 31.3% in 2022.

Specifically, Tianyuan Pets has cooperated with Kmart AUS, its largest customer, since 2011, and sales have shown a year-by-year growth trend, with a CAGR of 44.6% from 2014 to 2021.

5. Pet Industry: The global scale of pet products reaches US$159.6 billion, and the scale of pet products is US$44.8 billion.

The pet industry has a long history of development in developed countries, and the industrial chain is relatively complete and mature. , subdivided industries are developed, including pet food, pet medical care, pet supplies, pet grooming and pet insurance, etc. According to Tianyuan Pet's 2022 annual report, the retail scale of the global pet product market (excluding services) in 2021 will be US$159.6 billion, of which the global retail scale of pet supplies will be US$44.8 billion, and the pet supplies industry will maintain steady growth. The United States is the largest and most mature pet consumer market in the world. According to the American Pet Products Association (APPA), the U.S. pet market will reach 136.8 billion yuan in 2022, a year-on-year increase of 10.8%, and the compound growth rate from 2018 to 2022 will be 10.9%. In terms of categories, the total market size of pet supplies, live animals and pet over-the-counter drugs in the United States will be US$31.5 billion in 2022, a year-on-year increase of 5.7%, accounting for 23% of total sales. Sales channels for pet products in the United States include pet product specialty stores (PetSmart, Petco, etc.), large comprehensive hypermarkets (Walmart, etc.), supermarket chains, comprehensive e-commerce (Amazon, etc.), and pet e-commerce (Chewy, etc.).

Europe is the second largest pet consumer market in the world. According to the European Pet Food Industry Federation (FEDIAF), the European pet market consumption will reach 51.2 billion euros in 2021, of which the scale of pet products will be 9.5 billion euros. The sales channels for pet products in the European market mainly include traditional pet retail stores, gardening supermarkets, comprehensive supermarkets and discount stores. However, the product range and product positioning of retailers in different channels are different: traditional supermarkets and discount stores mainly provide mid-to-low-end and higher-end products. For high-selling pet products, professional pet retail stores will provide a full range of pet products including food, nest mats, cat climbing frames, toys, cleaning supplies, etc. In the Japanese market, according to the 2022 annual report of Yiyi Shares, the market size of the Japanese pet industry in 2020 was 1.6 trillion yen, a year-on-year increase of 1.9%. The Japanese pet market as a whole maintained low-speed and steady growth.

my country’s pet industry has shown a thriving development trend and has entered the fast lane of development since 2010. According to the 2022 China Pet Industry White Paper, the market size of China's pet industry will be 270.6 billion yuan in 2022, a year-on-year increase of 8.7%, and the compound growth rate in the past ten years has reached 23.2%. On the one hand, the increase in the penetration rate of pet ownership has driven the steady increase in the number of pets. The "2022 China Pet Industry Trend Insights White Paper" shows that my country's pet penetration rate in 2022 is 20%, which is still far lower than mature markets in the pet industry such as the United States. The penetration rates of pet households in the United States and Europe will reach 66% and 46% respectively. China's pet market still has a lot of room for development. As the number of pet owners in our country increases, the number of pets is expected to continue to grow. The "2022 China Pet Industry White Paper" shows that the number of dogs and cats in cities and towns and the number of pet owners will increase by 3.7% and 3.7% respectively year-on-year in 2022. 2.9%.

On the other hand, the increase in single-pet consumption will also drive the steady expansion of my country's pet supplies and service market. As residents' income levels increase, the average consumption of a single pet is expected to gradually increase. According to the 2022 China Pet Industry White Paper, the average annual consumption of a single dog and the average annual consumption of a single cat in 2022 will increase by 9.4% and 3.1% respectively year-on-year.

With the increase in my country's per capita income and the growth in the number of pet owners, the demand for pet products industry is expected to maintain steady growth. Judging from the proportion of category consumption in the pet industry, according to the 2022 China Pet Industry White Paper, China's pet products market share is currently relatively low, reaching 13.3% in 2022, and there is still considerable room for improvement. The penetration rate of the pet products market in 2022 will reach 80.4%, a slight increase from 2021. Among dog products, the penetration rates of toys, litter mats, and bath shampoo are higher, at 77.9%, 75.2%, and 70.7% respectively. Among cat products, the penetration rates of cat litter and toys are higher, at 91.2% and 84.8%, respectively.

6. Tianyuan Pet: An all-rounder covering all scenarios and all categories, creating a multi-category and efficient supply chain system

Some sub-industries of pet products have numerous categories, specifications and standardization Lower-level features mainly include pet nest mats, climbing frames, clothing, toys, traction travel, cleaning utensils and eating utensils, etc., covering diverse life scenarios such as "living, wearing, traveling and playing" for pets. and usage requirements. Tianyuan Pet's product range includes pet nest mats, cat climbing frames, pet toys, electronic supplies, pet clothing, pet traction equipment and other pet supplies, as well as pet food. The company has basically achieved extensive coverage of all categories of products in multiple scenarios such as pet living, eating, playing, clothing, cleaning, travel and human-pet interaction.

For pet product suppliers that provide multiple categories, continued enrichment of product development capabilities and efficient and reliable supply chain management systems are the core competitiveness in developing and maintaining long-term cooperation with overseas customers. Tianyuan Pet has been deeply involved in the pet industry for nearly two decades. In the process of development, it has continued to strengthen the construction and improvement of the supply chain management system. Based on the relatively abundant and mature supporting processing resources of light industrial small commodities in Jiangsu and Zhejiang regions of China, it has accumulated a relatively rich and complete set of supporting processing resources. The multi-category pet product supply chain management system can meet customers' one-stop, multi-frequency purchasing needs. For some multi-category pet product export companies, due to the large differences in raw materials and production processes required for various sub-categories, independent production of multiple categories at the same time lacks economic effects and disperses business management resources. The company is in a difficult situation. Pet products such as pet nest mats, toys, and cat climbing frames have the attributes of light industrial commodities. There are relatively mature supporting processing industry resources in Jiangsu and Zhejiang regions of China. Therefore, the company mainly uses the production model of outsourcing processing and focuses on high value-added core business segments. The internal business mainly focuses on multi-category product development and design, supply chain management, and customer development and maintenance, focusing on providing customers with efficient one-stop purchasing services.

7. Profit Forecast

The company’s revenue in 2023-25 is expected to be 2.04/2.42/2.93 billion yuan, a year-on-year increase of 8%/19%/21%, and the gross profit margin is 20. %/20%/20%, looking at different businesses:

(1) Pet products: As the inventory turnover of overseas customers gradually comes to an end, overseas demand has steadily picked up, and the company’s overseas sales revenue of pet products is expected to gradually increase improve. At the same time, the company's international marketing department will focus its main resources on building big customers, promote the key customer strategy in terms of customer structure, category structure, market depth, etc., deeply develop key categories such as cat beds and dog houses, and actively introduce overseas local market team talents to strengthen Sales front-end localized service capabilities, and accelerate the pace of overseas supply chain system construction. The company's pet products business revenue is expected to be 1.33/1.5.0/1.73 billion yuan respectively in 23-25 years, with year-on-year growth of -2%/13%/16% respectively; the gross profit margin of the pet products business is expected to remain stable and increase, with a year-on-year growth rate of -2%/13%/16% respectively. 22%/22%/23% respectively.

(2) Pet food: In terms of pet food business, the company currently mainly introduces internationally renowned brands to the domestic market and carries out import and sales of pet staple food through cross-border e-commerce. At the same time, the company expands general trade by The channel import business is expected to expand the scope of cooperation with imported pet food brands and expand the coverage of sales channels in the future. The company's pet food business revenue is expected to be 6.9/9.0/1.17 billion yuan respectively in 23-25, a year-on-year increase of 35%/30%/30% respectively; the gross profit margin of the pet food business is expected to remain stable with the rapid expansion of scale, from 23-25 The annual estimates are 15%/15%/15% respectively.

As an early pioneer in the pet industry in China, the company has become a full-category, large-scale comprehensive pet product supplier in China after nearly two decades of focus and accumulation. The company has certain first-mover advantages in serving the global pet market and has a strong development and supply system. In the domestic market, the company actively develops pet food distribution business and has the potential for joint development of food synergy supplies. In terms of industrial chain layout, the company has positioned itself as a multi-category and wide-range product supply platform, making full use of the region’s rich industrial supporting resources and possessing the unique attributes of a multi-category platform supplier. Tianyuan Pet is a comprehensive supplier of pet products, and the destocking of overseas customers is expected to gradually come to an end. The company is focusing on pet food import business. We estimate that the company's net profit attributable to the parent company in 23-25 will be 1.4/1.7/210 million yuan respectively.

扫一扫微信交流

扫一扫微信交流

发布评论