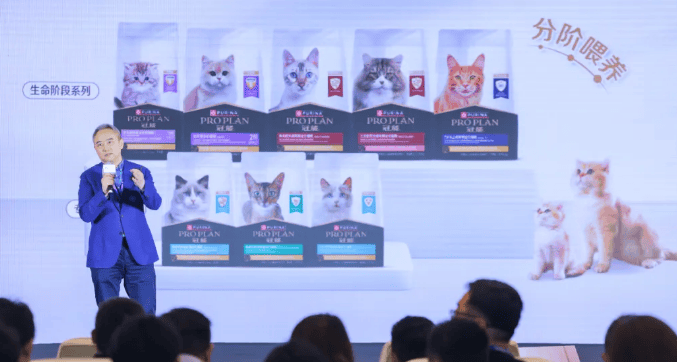

Pet industry news: On March 1, the China Pet Nutrition and Health Forum was held as scheduled at the National Convention Center in Beijing. At the meeting, led by the Chinese Nutrition Society and jointly with a number of authoritative academic institutions and industry experts, the first simplified version of the "China Pet Nutrition and Feeding Guidelines" was released on the spot. At the same time, Nestlé Purina also released the "Pet Stepped Feeding Manual" created with great care.

Regarding the release of the "China Pet Nutrition and Feeding Guide" and the "Pet Staged Feeding Manual", Chen Xiaodong, head of Nestlé Purina Pet Food Business in Nestlé Greater China, said at the scene, "As one of the pioneers in China's pet health industry, Nestlé Purina has always adhered to the brand concept of providing better nutrition for Chinese pets. It is also the leading unit in science popularization and industry practice of the "China Pet Nutrition and Feeding Guide". Based on the core concepts in the guide, Nestlé Purina specially released the "Chinese Pet Nutrition and Feeding Guide". "Pet Feeding Manual" to jointly promote the professional development of the pet food industry."

Based on this, the pet industry expert interviewed the person in charge of Nestlé Purina's pet food business in the Greater China region after the meeting. Chen Xiaodong, as well as Nestlé Purina’s global R&D and product expert team, exchanged views on Nestlé Purina’s layout and future plans in terms of brands, channels, products and R&D.

The following are the notes compiled by pet industry experts based on the on-site interviews, with slight modifications:

Q:

The release of the "Pet Step-by-Step Feeding Manual" has attracted widespread attention. Can you share the original intention and significance of Purina publishing this manual?

A: Chen Xiaodong, head of Nestlé Purina pet food business in Nestlé Greater China:

The release of the "Pet Stepped Feeding Manual" is actually a response to the domestic pet industry Two emerging characteristics:

On the one hand, many domestic families are raising pets for the first time and lack experience. Pets are different from humans. There is no parenting experience passed down from generation to generation to learn from. Therefore, many families feel at a loss when facing new members. Therefore, many consumers are very thirsty for pet nutrition and pet knowledge, but a large number of consumers only I can find answers on Xiaohongshu, Douyin, Zhihu and other platforms, but there is no textbook to refer to.

On the other hand, the pet industry itself is still a relatively new industry. With the development of social economy, the number of pet-raising families continues to increase, but the pet industry itself is still exploring mature management and supervision methods. The combination of various factors has led to the industry's urgent need for programmatic documents that can truly guide consumers and the entire industry. For example, the "China Pet Nutrition and Feeding Guidelines" released by the Chinese Nutrition Society provides more comprehensive guidance on pet nutrition and feeding.

The "Pet Stepped Feeding Manual" is based on the "Chinese Pet Nutrition and Feeding Guide", Nestlé Purina has explored the three core points of pet nutrition: comprehensive, balanced, Grading. These three points can be compared to human diet. Currently, in the field of human nutrition, there is no suggestion that children should only eat meat at home and not eat vegetables. It must emphasize balance and comprehensiveness, and it must be staged, and what people at different stages eat. Not the same either. In fact, the same is true for pets.

In the "Pet Staged Feeding Manual" released by Nestlé Purina, the life stages of pets are divided into the immune construction period in the juvenile stage, the immune maturity stage in the adult stage, and the anti-aging stage in the elderly stage. To put it simply, there are specialized juvenile formula products for children, adult formula products for adults, and senior formula products for the elderly, and each stage specifically addresses the pain points that users are concerned about;

And Judging from the individual differences and special nutritional needs of pets, no two leaves in the world are exactly the same, especially for pets. Pets also have different needs based on living environment, breed nature and individual personality factors. Common special needs include: intestinal, weight, and urinary needs of pet cats, as well as intestinal, skin health, and weight needs of pet dogs. In this regard, Nestlé Purina has also launched specialized product series to solve different problems.

Based on these two full lines of nutrition and product solutions launched in the "Pet Stepped Feeding Manual", Nestlé Purina also believes that it can meet the nutritional needs of pets in different situations throughout their life cycle. .

Q:

What value will the release of the "Pet Stepped Feeding Manual" bring to the pet industry and practitioners?

A: Chen Xiaodong, head of Nestlé Purina pet food business in Nestlé Greater China:

First of all, the "Pet Feeding Manual" can let consumers understand why they need to feed in stages. Key issues in feeding. Starting from core needs, the manual describes the different stages of life and the specific needs of each stage, providing nutrition and food solutions throughout the life cycle. This is a scientifically based staged feeding concept that solves a major pet feeding problem for consumers.

Secondly, this manual is also a valuable resource for practitioners. In the past, pet practitioners lacked professional standards to refer to, but this book provides a standardized reference framework to help improve the professional skills of pet breeding, pet medical and pet shop practitioners.

Ultimately, we hope that this manual will become a recognized standard in the industry and contribute to the healthy and sustainable development of the pet industry. Nestlé Purina has always been committed to sharing good products and knowledge, especially knowledge related to pet food. This is the basic logic of Nestlé's business. Through the Purina Research Institute, a non-profit organization, Nestlé hopes to share its knowledge and technology accumulation with the industry, while absorbing excellent practices in the industry to jointly promote the progress of the pet industry.

Q:

Another question is related to channels. If you analyze the entire channel, you will find that the development of e-commerce and live broadcasting continues to squeeze offline channels. What do you think of this trend? At the same time, how does Nestlé Purina combine offline channels with products to make more innovations and breakthroughs?

A: Chen Xiaodong, head of Nestlé Purina pet food business in Nestlé Greater China:

The current main consumers in the pet industry are those born in the 1990s and 2000s. These user groups are Growing up in a highly digitalized society and e-commerce consumption environment, shopping habits tend to be more online. This may pose certain challenges to offline channels, but it does not mean that the value of offline channels is weakened. On the contrary, I firmly believe that for brands to succeed in the pet industry, the role of offline channels is irreplaceable.

On the one hand, offline channels are not only core channels for disseminating knowledge and cognition, but also channels that are urgently needed in many service scenarios. These rigid needs will not be moved online. For example, pets must go to the hospital if they are sick. Currently, there is no possibility of online surgery and treatment for pets. Most pet washing and beauty services still require washing in stores, because offline stores will provide a complete set of services; In addition, dog owners are naturally social and eager to communicate and share. In this scenario, pet stores play the role of communication, sharing, and knowledge dissemination among pet owners, and the satisfaction of this face-to-face, real-time communication is difficult to replace online.

Therefore, Nestlé Purina has specially focused its promotion of professional care series on offline channels this year. Through face-to-face communication and experience, consumers can more intuitively understand the effects and nutritional value of products. This kind of interaction cannot be completely replaced online.

On the other hand, I personally believe that offline channels are in a quiet period before change in recent years. It looks like it's not moving, but in fact there's an undercurrent surging underneath. In the face of online channel competition, the industry concentration, chaining, and service capabilities of the entire offline channel are being improved. Whether it is the service standardization of pet hospitals, the professionalization of pet grooming, or the standardized operation of pet shops, developing towards a higher level. At the same time, offline channels are also actively undergoing channel changes and innovations. For example, local life, instant retail, etc., these changes are all positive responses to online challenges, ultimately giving consumers better offline scenarios and services.

In response to these, Nestlé Purina also proposed the concept of global marketing. It does not simply emphasize online or offline channel strategies, but balances online and offline resources, strengthens the concept of global services, and provides customized products and services according to the different needs of consumers. Frankly speaking, this full-domain service model is more demanding than traditional business services, but if done well, it can also become the core competitiveness of the enterprise.

Q:

In Nestlé’s latest global financial report, the pet products sector was highly praised, especially in the Chinese market. What do you think are the unique characteristics of the Chinese market in the pet industry? What trends do you predict will emerge in 2024 that are different from other markets?

A: Chen Xiaodong, head of Nestlé Purina pet food business in Nestlé Greater China:

Compared with markets in North America and Europe, the Chinese market is still relatively low-integrated , the industry has not yet formed a few dominant brands, which is in sharp contrast to the mature and highly competitive market environments in North America and Europe. At the same time, China's pet industry is still in the process of development and maturity, and consumers are relatively new and willing to accept new things, which provides a broad space for the emergence of new brands and new concepts. At the same time, the situation is also an objective factor. Based on the immature market environment, some concepts that are not systematic or have no scientific basis still exist. This is a unique regional characteristic of China’s pet market.

Regarding future market development trends, the first big change is that consumers have become more rational. In the past, there was no best, only the most expensive. You would buy whatever was expensive. But now consumers are becoming more and more rational. They no longer just pursue expensive products, but start to pay serious attention to the nutritional value and scientific basis of pet food. This also marks the market's gradual return to product essence and quality.

Secondly, the Chinese pet market itself is also gradually evolving. Against the background of increasingly rational consumer demands and slowing market growth, the degree of formalization, concentration and service standards of the entire industry are quietly improving. A distinctive feature is that both international and local brands continue to make deep investments in R&D and production. In the past, we may have pursued speed more quickly, but now we have returned to a very "clumsy" but truly sustainable development model. The same goes for channel service providers who provide services. Whether it is beauty treatment, breeding, or medical groups, etc., the degree of chaining is getting higher and higher, the standardization and professionalism of services are getting stronger, and the development is getting faster and faster. The result is that consumers can enjoy better products and services, which is actually good news.

Finally, society as a whole is becoming more and more tolerant of pets. Nowadays, more and more pet-friendly shopping malls, pet-friendly hotels, pet-friendly flights, and even offices where pets can be brought to work are becoming more and more common. This not only improves the relationship between people and pets, but also reflects society’s acceptance and respect for pet culture.

In general, although the development speed of China’s pet market has slowed down in recent years, with the participation of more high-quality companies, the maturity of consumer behavior and the improvement of overall social tolerance, I am optimistic about the future development of the pet industry in China.

Q:

Competition in the pet food industry is known as the most intense part of the entire pet industry. With a new round of reshuffle in the industry, the number of employees in China's pet food industry Are operators facing structural adjustments and changes to cope with demand? In addition, with the development of the market, what new requirements have been put forward for enterprise innovation?

A: Chen Xiaodong, head of Nestlé Purina pet food business in Nestlé Greater China:

I think this is a natural survival of the fittest. In fact, looking at the entire pet food industry in China, the volume is only around 50 billion, but now there are more than 30,000 pet brands. You can imagine how fragmented the industry is. After so many brands come in, competition will become very fierce. Faced with this competitive environment, structural adjustments and changes in the industry are inevitable, which can be analyzed from several dimensions:

1. In any industry, the more competition, the better it can develop. This is a necessary stage for the development of an emerging industry. Because only when a hundred flowers bloom and the eight immortals cross the sea to show their magical powers, all focusing on making better products, can we promote the development of this industry. Nestlé Purina is open to market competition, because intensified market competition can also promote the natural selection of the industry and optimize the structure of the entire industry market, so that companies with true core competitiveness can eventually stand out.

2. In the face of fierce market competition, practitioners must adhere to the bottom line and principles of the industry, especially in terms of pet nutrition and health. For example, the guidelines released this time have given everyone a basic consensus on pet nutrition and the basic capabilities of the industry. In other words, everyone recognizes that comprehensive, balanced, and graded are the most basic core needs of pet nutrition. You cannot develop the market without these things. compete. This requires companies to not only pursue innovation and differentiation, but also ensure the scientificity and safety of their products. If this bottom line cannot be maintained, consumers, employees and even the industry itself will be greatly affected.

3. Whether it is a domestic-funded enterprise or a foreign-funded enterprise, the one that ultimately survives and can develop sustainably in the market must be a truly consumer-centered enterprise. This means that companies need to truly focus on Chinese consumers, analyze their actual needs, and provide products and services that meet their expectations.

For Nestlé Purina, as one of the world's leading pet food companies, providing comprehensive products and services for pet families with different needs is our unchanging commitment in the face of competition and market changes. . Therefore, Nestlé Purina product lines must cover various market segments such as high-end, super-high-end, and mass markets, and distribution channels must be comprehensive, broad, and in-depth distribution, in order to allow more than 71 million pet families in China to enjoy science, nutrition, and delicious food s solution.

Q:

Both the pet nutrition guide and the step-by-step feeding manual provide key support for healthy pet raising. In view of consumers’ increasing awareness of the concept of healthy pet care, what do you think of the future trend of pet health?

A: Chen Xiaodong, head of Nestlé Purina pet food business in Nestlé Greater China:

On the one hand, consumers are becoming more and more rational, and they no longer just pursue expensive pets. products, but pay more attention to the scientific basis and nutritional value behind the products. Consumers must truly know the scientific basis behind this product in order to convince them to make a purchase decision. Therefore, consumers’ concept of rational consumption is actually promoting the development of pet health.

On the other hand, I am very optimistic about the concept of pet health. Not only pet food, but also subdivided into medical, beauty care, insurance and other fields according to broad categories, all of which are part of pet health. But in essence, it still responds to the changes in the needs of more pet owners and the changes in the human-pet relationship. Therefore, consumer demand and consumer concepts are the essence of the development of the entire industry.

Q:

While discussing consumers’ tendency to consume rationally, we also see that the positive emotional value provided by pets is increasing day by day. How do you see the connection between rational consumption and emotional value, especially for young pet owners who pursue cost-effectiveness but are also willing to accept a premium for emotional value?

A: Chen Xiaodong, head of Nestlé Purina pet food business in Nestlé Greater China:

Emotional value is an indispensable part of consumption decision-making, and it is often rational consumption. the premise of behavior. In other words, it is precisely because pets have increased their emotional status in the family and become important family members. This emotional bond drives pet owners to pay more attention to choosing products and services that are truly beneficial to their pets. This does not mean that consumers consume blindly, but that after full understanding and research, they will choose the products that are most suitable for the healthy development of their pets, even if it means paying a higher price.

As the relationship between people and pets becomes more equal and closer, consumption will eventually become more rational. But rationality does not mean spending less and less, but it means that consumers regard pets as family members and will be more responsible when making purchase decisions. If the product can meet the specific needs of the pet owner, he will definitely be willing to spend money.

Q:

China’s pet market has been growing. Nestlé Purina’s pet business also achieved double-digit growth in 2023, coupled with market integration and concentration The reason why the popularity is relatively low allows more new brands or cross-border brands to see opportunities to enter the pet market. From your perspective, how does Purina view this kind of market competition, and how should it respond?

A: Chen Xiaodong, head of Nestlé Purina pet food business in Nestlé Greater China:

As mentioned just now, Nestlé Purina welcomes market competition. Let’s focus on the specific response methods:

First, diversified production line layout. In the ultra-high-end track, we have introduced cross-border products such as North American high-end brand Merrick and PRO PLAN LiveClear; in the high-end scientific nutrition track, we have taken the lead through GN; at the same time, Zhenzhi, the representative of wet food, has basically achieved localized production in the Chinese market; in the mass price range, Purina also has products like Xiyue.

These four major brands can basically cover consumers in various price ranges, including dry food and wet food, as well as the different needs of cats and dogs in different physiological conditions.

The second is the channel construction of global marketing. The consumption environment of Chinese consumers is developing rapidly, which means that their requirements for products and services will also increase, and they even hope to get good product and service experience anytime and anywhere. Behind this are the possibilities brought about by technological progress. For example, the changes in emerging channels such as live broadcast e-commerce, local life, instant retail, etc. are very significant. But this kind of volume is a positive volume, which will ultimately allow Chinese consumers to enjoy the most convenient services in the world. Since to survive in this market, it must adapt to the basic market environment, so Nestlé Purina must establish global marketing capabilities. Provide customized products and services anytime and anywhere according to the different needs of consumers.

The third is a consumer-centered core operating system. For example, Purina has accumulated millions of fans through years of accumulation. Last year, Purina began to build a member service system one after another, and this year we hope to gradually see results. The main purpose of this membership service system is to hope that loyal consumers, including new consumers, can truly obtain valuable information and suggestions when their new favorites arrive home through the membership service system, and provide them with daily consultations and community sharing. , get some reasonable recommendations on new products and nutritional theories at any time. Purina hopes to establish these four systematic service capabilities in member services as soon as possible, so that at least current Purina members can enjoy this service. And in the future, as more members enter this system, they will be able to enjoy more high-quality services.

Q:

What is Nestlé Purina’s current main focus and direction in product research and development?

A: Dr. Brittany Vester Boler, Global Product R&D Director of Nestlé Purina:

Purina has a profound foundation in research and development. There are more than 500 scientists worldwide, and they invest heavily in product innovation every year, seeking new discoveries and product breakthroughs, and promoting them in the global market. In other words, Purina has new product launches in different markets.

Among them, with the help of digital media, we can learn more about how pet owners and pets interact at home, or what the lives of pets are like. Through these we can gain new knowledge, new understanding, and new insights, which further supports Purina's product innovation and research and development.

At the same time, Purina continues to pay attention to all aspects of pet nutrition and health. For example, the digestive system, intestinal flora, as well as the brain function, cognitive function, joint movement function, immune system, etc. of adult or elderly pets, etc., and use this as the direction of product development.

In addition, from the perspective of product research and development, Purina is very concerned about how to meet the pain points, hopes and expectations of consumers. It also pays great attention to pet nutrition projects, such as how to make pets healthy. More balanced nutrition, health, etc., as well as concepts such as pet food that some consumers prefer, are also what Purina will pay attention to.

Q:

Given the unique consumption trends and national conditions of China’s pet industry, what do you think of the product trends and innovation directions of the Chinese pet market?

A: Dr. Haiqing Yu, Head of Nestlé Purina Asia Pacific & Greater China R&D Center:

Observing the Chinese pet market, we can find some unique consumer trends. First of all, the pet-loving mentality of Chinese pet owners is similar to international trends, and they all strive to provide a healthy and nutritious life for their pets. However, the Chinese market also shows its unique consumption characteristics and needs:

On the one hand, Chinese pet owners have their own understanding of how to care for their pets. Such as preference for cats and special requirements for pet diet, etc. Among them, China's pet food market pays more attention to localized ingredients, such as traditional Chinese herbal ingredients application products, which are continuing to enter the Chinese pet food market. Some products are very innovative, and some products require further verification of safety. Nutritional and research reliability. This not only reflects the characteristics of Chinese culture, but also reflects consumers' meticulous attention to pet health.

On the other hand, Chinese pet owners attach great importance to gaining knowledge from reliable information sources to make informed product choices. This information-seeking behavior drives the market's acceptance of high-tech and innovative products, such as LiveClear and Merrick, which have won widespread recognition from consumers for their technological innovation.

Faced with such market dynamics, I believe that the product trends and innovation directions of the Chinese pet market will pay more attention to health and nutrition, while incorporating Chinese cultural elements and the specific needs of consumers. Future innovation will not only be limited to innovations in product formulas and ingredients, but will also include in-depth understanding of consumer behavior and rapid response to market demand, ensuring that pet products are both scientific and in line with the cultural and emotional needs of Chinese pet owners.

Q:

Dr. Haiqing Yu mentioned the uniqueness of the Chinese market and would like to know how Nestlé Purina’s product development strategy in the Chinese market differs from other mature markets?

A: Dr. Haiqing Yu, Head of Nestlé Purina Asia Pacific & Greater China R&D Center:

First of all, I am very proud of Purina’s global innovation strategy . Nestlé Purina has more than 100 years of pet research history, and continuous innovation on a global scale is our tradition. In this process, Purina is committed to collecting new ideas, tracking major trends, and applying these innovations to meet the needs of global consumers, of which the Chinese market is also an important part.

Our product research and development strategy in China not only leverages the support of our R&D team of more than 500 scientists, but also focuses specifically on meeting the specific needs of Chinese consumers. For example, after GN's LiveClear series of products were launched in the United States, South America and European markets, they were also introduced to the Chinese market. This is a direct application of the innovation results of the research institute. At the same time, Purina's R&D center in Singapore is also committed to studying market needs in the Asia-Pacific region, including China, looking for demand points that have not been fully met, and using global resources to innovate.

A: Dr. Sheri Smithey, Senior Vice Chairman of Nestlé Purina Global R&D Center:

As a global company, Nestlé Purina has invested heavily in the Chinese market. It not only conducts in-depth research on the market Unique, we are also committed to adapting and transforming innovations from the global market to the Chinese market. Purina's goal is to make product innovations that resonate with the needs and preferences of Chinese consumers, rather than simply copying and pasting successful models from other markets. Therefore, Purina's R&D strategy in the Chinese market aims to deeply understand the special needs of the Chinese market and combine global perspectives and resources to promote product innovation to better serve Chinese pet owners and pets. "

Q:

How does Purina conduct product development and innovation based on the actual needs of pet owners? Taking the Changfu series of products as an example, how was this product developed for pet owners’ allergies?

A: Dr. Sheri Smithey, Senior Vice Chairman of Nestlé Purina Global R&D Center:

Purina attaches great importance to product development and innovation based on the needs of pet owners. There are two key levels involved. The first is to communicate directly with pet owners around the world to understand their specific needs for pet nutrition and health; the second is to work closely with veterinarians to deeply explore pet health issues, especially those with high incidence of diseases and issues of common concern to pet owners.

Take the Changfu series of products as an example. This product is designed to reduce allergic reactions of pet owners. It is based on Purina's in-depth research on allergies caused by pets and direct feedback from consumer needs. Purina noticed that some pet owners are unable to have close contact with their pets due to allergic reactions to their pets, which is a big challenge for both owners and pets.

In addition, through cooperation with veterinarians, Purina understands the scientific mechanisms behind specific health problems, such as symptoms such as cognitive impairment that may occur in elderly pets, and then targets these problems. sexual research and development.

Purina’s R&D team will also conduct in-depth research into pets’ nutrient absorption and metabolic pathways to develop products that can specifically solve these problems. During the product development process, Purina also pays great attention to consumers' taste preferences and product quality requirements to ensure that the products are not only scientific and effective, but also meet the actual needs of pets and pet owners.

On this basis, Purina has gone through a series of rigorous tests and verifications to ensure that product solutions can actually solve the problems faced by pet owners before finally launching the product to the market.

Q:

Nestlé Purina has a huge global R&D center around the world. What is the underlying logic and methodology for research and exploration in the field of pet nutrition science?

A: Dr. Sheri Smithey, Senior Vice Chairman of Nestlé Purina Global R&D Center:

The underlying logic of Nestlé Purina’s research and exploration in the field of pet nutrition science is to make pets and Pet owners can have a very good companionship relationship with each other. This project has been in development for a long time and co

扫一扫微信交流

扫一扫微信交流

发布评论