1 Deeply engaged in the pet food field for more than 20 years, building a leading pet chew company

1.1 Business matrix: from a single chew to multiple pet food categories

Petti The company is an outstanding manufacturer in the domestic pet food field. The company's main business is positioned at the research and development, manufacturing, sales of pet food and pet product brand operation. The company has continuously expanded its product categories since its establishment. The early products were mainly pet chewing foods such as animal hide chews and plant chews, and later expanded. Food categories include pet nutritional meat snacks, pet staple food, pet health food and other food categories, mainly for dogs and cats and other pets.

1.2 Development History: Seizing the opportunity of market upgrading , embarking on the journey of globalization

Petit Co., Ltd. was established in 2002, and the core team started the business in 1992. The company initially took Wenzhou as its base and took advantage of the local leather craftsmanship to successfully develop China's first generation of dog chews and presided over the formulation of the national standard "Pet Food - Dog Chews". In 2009, Petty was inspected by officials from the European Food and Veterinary Office and received official approval. In order to achieve global supply, Petty set up a factory in Vietnam in 2013 and established Vietnam Haoqiao. With the advantages of raw materials, labor and tariffs, it accelerated the development of overseas markets. The company's chewing products have been updated from the second generation pure animal skin and meat chewing chews to the third generation. Five generations of mixed animal and plant fiber chewing gum. At that time, the average product in European and American countries was in the third generation. With its strong R&D capabilities, Petty seized the opportunity of market upgrading and gradually made the business bigger and stronger. Since then, it has also established businesses in Cambodia and New Zealand. There are large-scale production bases. In 2017, Petty launched its A-share IPO. In 2018, seeing the development opportunities and huge space in China's pet market, Petty launched a two-wheel drive strategy to develop the domestic market and cultivate "Jueyan", "Haoshijia", With independent brands such as "Zhi Neng", the product categories are gradually developing from pet snacks to full categories of pet food.

1.3 Equity structure: The Chens and his wife are the actual controllers of the company, and domestic and foreign subsidiaries complement each other

The company’s equity structure is stable and concentrated in the Chen family, and the company has large-scale production in many places base. Chen Zhenbiao and Zheng Xianglan are the founders and actual controllers of the company, holding a total of 34.6% of the company's equity, and the ownership structure is concentrated and stable. At present, the company has a number of subsidiaries, including Jiangsu Kangbei and Taizhou Lepai domestically, and overseas subsidiaries such as Vietnam Haoqiao, New Zealand North Island Town Group, and Cambodia Juewei. Relying on the comparative advantages of various regions, the subsidiaries optimize resource allocation to reduce production costs and complement each other to produce high-standard pet food.

1.4 Operating conditions: Operating conditions are good, revenue continues to grow

Revenue continues to grow, but performance will be under pressure in 2023H1 due to overseas inventory adjustments. From 2014 to 2022, the company's operating income increased from 397 million yuan to 1.732 billion yuan, with a CAGR of 20%. The revenue scale in 2022 hit a record high, and H1 revenue in 2023 was 493 million yuan, -41.8% year-on-year. In 2022, the company will achieve net profit attributable to the parent company of 130 million yuan, +111.8% year-on-year. In H1 of 2023, net profit fell due to a decrease in overseas inventory adjustment orders. It is expected that with the end of the subsequent inventory adjustment cycle of overseas customers, net profit will turn from loss to profit.

From a category perspective, the rubber chewing business’s revenue share has stabilized at more than 60% over the years, and the staple food business’s revenue share is expected to continue to increase in the future. In 2022, Petty chew products will achieve revenue of 1.193 billion yuan, accounting for 69%. Among them, plant gum chews achieved operating income of 649 million yuan, accounting for 37%; animal skin chewing gum achieved operating income of 544 million yuan, accounting for 31%. The meat snack business relies on the hot-selling strategy of large single products. The revenue scale will continue to grow from 2016 to 2022, from 18 million yuan to 338 million yuan, accounting for 19% of the revenue in 2022; staple food and wet food products will increase from 2016 to 2022. Large-scale sales will begin in 2020. In 2022, operating revenue will reach 160 million yuan, accounting for 9.2% of revenue. Revenue in the first half of 2023 will be 61 million yuan, a year-on-year increase of 1.56%. Currently, the company's New Zealand staple grain factory is in the trial operation stage. It is expected that as the staple grain production line gradually increases its volume, the revenue share of the staple grain business is expected to continue to increase in the future. From a regional perspective, the current main source of the company's revenue is still foreign business, and it continues to focus on the domestic market. The company adopts the "one body and two wings development strategy" domestically and overseas, and while actively seizing overseas market opportunities, it also vigorously develops the Chinese domestic market. In 2022, Petty's overseas sales revenue will be 1.456 billion yuan, accounting for 84%, a year-on-year increase of 37%; domestic revenue will be 275 million yuan, accounting for 16%, a year-on-year increase of 30.91%.

The decrease in overseas orders has dragged down the gross profit margin, and the gross profit margin of plant chews has remained high. On the one hand, the Sino-US trade war that started in 2018 brought additional tariffs and exchange rate changes, resulting in a reduction in orders for overseas products with higher gross profit margins; on the other hand, the implementation of the equity incentive plan in 2018 caused an increase in sales expenses, and the gross sales profit margin increased from 2017 to 2017. From 37.27% in 2017 to 22.3% in 2022, the net sales profit margin dropped from 16.91% in 2017 to 7.47% in 2022. It is expected that the company's overall gross profit margin will continue to improve as orders for plant chews, a product with high gross profit margins, recover. The gross profit margin in the domestic market has gradually increased. In terms of regions, the gross profit margin of foreign sales in 2022 will be 22.1%, showing a downward trend year by year. After proposing a two-wheel drive strategy at home and abroad in 2018, the company began to focus on the domestic market, and the domestic sales gross profit margin increased from 13% in 2019 to 23.6% in 2022. In terms of products, the gross profit margin of plant gum chews is relatively high, but it has shown a downward trend in recent years. The gross profit margin of plant gum chews in 2022 will be 28.7%, a decrease of 10.6% compared with 2018. Plant chews use plant starch and chicken as the main raw materials, so the cost is relatively low.

Sales investment continues to rise. Petty's sales expenses in 2022 will be 87 million yuan, a year-on-year increase of 58.37%. This is mainly due to the preliminary investment necessary for the company to actively expand the domestic market and build its own brand, of which the increase in sales personnel and advertising expenses account for the main part.

2 The pet food track is in the ascendant, and the trend of localization is opening up a new world of consumption

2.1 Pet food: Domestic substitution accelerates breakout, and multiple factors drive rapid development

2.1 .1 Industrial chain: The pet industry chain pattern is relatively mature, and the pet food market is highly prosperous

The pet industry industry chain covers all aspects of pets’ needs, and is mainly divided into pet food, pet supplies, pet medical care and There are four major categories of pet service markets. Among them, pet food has become the largest market in the pet industry due to its rigid demand, high-frequency consumption attributes and easy branding. According to the 2022 Pet White Paper, my country's pet food will account for approximately 50.7% of the pet consumption structure in 2022. Pet food can be divided into pet staple food, pet snacks and health products based on its form, function and nutritional content.

The pet food market is huge, and dry food leads the pet food market. According to Euromonitor data, the market size of my country's pet food industry has grown from 6.3 billion yuan in 2013 to 48.7 billion yuan in 2022, with a nine-year CAGR of 26%, far exceeding the global 4% in the same period. As people's awareness of feeding commercial food increases, the market demand for pet food will be further released. China's dry pet food market has reached 38.1 billion yuan, accounting for 78% of the overall pet food market. It is the first choice for pet owners' food consumption expenditure. Due to its characteristics of good palatability, freshness and health, wet food will rank second in market size in 2022, reaching 6.4 billion yuan. Against the background of increasing emotional drive and health concerns, pet owners are feeding more pet snacks, and the popularity of pet snacks continues to increase. The market size will increase from 2.1 billion yuan in 2018 to 4.1 billion yuan in 2022.

2.1.2 Development-driven: Multiple factors resonate to promote the prosperous development of the pet food market

The economic level has laid the foundation for the pet-raising craze, and there is still room for improvement in the penetration rate of pet-raising in China. . According to research by the School of Veterinary Medicine at China Agricultural University, when a country’s per capita GDP reaches US$3,000-8,000, the pet industry will develop rapidly. In 2008, my country's per capita GDP exceeded US$3,000 for the first time, and has continued to rise since then. By 2022, my country's per capita GDP has reached US$12,720. A correlation analysis based on the pet-raising rate and per capita GDP in different countries in 2021 shows that the rate of household pet-raising in developed countries such as the United States, Australia, Japan, and the United Kingdom is higher. The United States has the highest pet-raising rate in 2021, as high as 70%. China's pet-keeping penetration rate in 2021 is only 25%, which is far lower than mature markets in the pet industry such as the United Kingdom and the United States. There is still room for improvement in the future.

Increased income levels drive consumption upgrades, and single pet expenses increase. In recent years, the per capita disposable income of residents in our country has continued to grow. In 2022, the per capita disposable income of residents in our country has exceeded 50,000 yuan and continues to grow; with the increase in per capita disposable income, the purchasing power of pet owners has increased and they can afford higher prices. The cost and expenditure of pet keeping have also increased. In 2022, the average annual consumption of a single dog will be 2,882 yuan, an increase of 9.4% from 2021; the average annual consumption of a single cat will be 1,883 yuan, an increase from 2021 3.1%. There is still a certain gap in the consumption amount of a single dog or cat.

Changes in the demographic structure have led to an increase in pet ownership, with pet cats ranking first in popularity. Against the social background of an aging population and changes in young people’s views on marriage and love, the number of people living alone in China is growing. In 2022, the number of people living alone in China will increase from 70 million in 2013 to 150 million. Elderly people living alone, single-child groups and single young people have increased emotional needs for pets. The lack of companionship from relatives has led these groups to regard pets as emotional sustenance. The family attributes of pets have been strengthened, and the number of pet owners has maintained an upward trend. According to Euromonitor data, the number of pet cats and dogs in China has reached 186 million in 2022, including 98.96 million pet cats and 86.72 million pet dogs.

At present, the growth in the number of pet cats and dogs is showing a weak trend, and the subsequent market expansion of pet food may mainly rely on the two core driving forces of single pet food consumption and pet food unit price. The number of pet cats continues to rise, and after reaching a peak in 2016, the growth rate has gradually slowed down to low single digits; the number of pet dogs has been decreasing in the past two years, and will fall back to the level of 2018 in 2022. This is mainly due to Because pet dogs are subject to stricter dog breeding regulations in some areas, and pet dogs have been kept for a longer period of time, the aging of pet dogs is coming earlier. Pet cats are now more popular than pet dogs mainly because the pace of urban life is fast, young people live in smaller areas and have less free time, making it difficult for them to go out frequently to walk their dogs. However, it is relatively easy to raise pet cats.

2.1.3 Market structure: Domestic substitution is beginning to show results, brand concentration is relatively dispersed

Industry concentration is low, and the development trend of multi-brand matrix will continue. According to Euromonitor data, China's pet food industry CR5 dropped from 26.5% in 2016 to 17.4% in 2021. On the one hand, the emergence of domestic domestic brands in recent years has broken the strong position of foreign brands, and the concentration of the pet food industry has decreased; on the other hand, the multi-brand strategy adopted by various pet food companies has led to a relatively dispersed concentration of pet food brands. From the perspective of industry characteristics, the multi-brand matrix can not only satisfy consumer groups in the mid- to low-end and high-end fields, but also enable the group's R&D, production capacity and channels to produce scale effects. In the future, my country's leading pet food companies may continue to deploy multi-brand strategies to accelerate breakthroughs. In the short and medium term, the brand landscape will still be dominated by low concentration.

Looking at dogs and cats, domestic brands have more advantages in pet dog food. McFoodie ranks first in market share, and domestic brands such as Bernardine, Naughty, Lilang, Odin, Nike, and Birich rank among the top ten brands. Among pet and cat foods, foreign brands account for a higher proportion, and Royal ranks first in market share. Domestic brands occupy only 4 of the top ten brands, including McFoody, Naughty, Bernard Tianchun, and Birich. Overall, the domestic substitution of pet cat and dog food has begun to show results, but homogenization competition is fierce, the competition landscape is still fragmented, and a monopolistic leading enterprise has not yet been formed.

2.2 Pet Chews: The segmented demand for pet snacks is expected to be continuously tapped

2.2.1 Chews lead the consumption trend of healthy pet care, and the advantages of raw materials provide fertile ground for the development of chews

p>

Gum chews are chewable snacks for pets. Compared with dried meat snacks, they have higher requirements on manufacturing technology and have been widely favored by pet owners in recent years. According to the main raw materials, chewing gum is mainly divided into two categories: animal hide chewing gum and plant chewing gum. Livestock hide chewing gum is mainly made from the second layer of skin of cattle, pigs and other animals. It has the advantages of strong toughness, good elasticity and wear resistance; Plant-based chews are made from plant starch, livestock and poultry meat and other main raw materials. In addition to the characteristics of traditional livestock skin chews, they are also easy to digest, rich in categories, and exquisite in appearance. Chew chews have different shapes, most of them are like bones, bones, sticks and other strips, which are in line with dogs' preference for chewing bones. They are mainly used for cleaning dog teeth and supplementing extra energy and nutrition.

The upstream and downstream industrial chains of livestock hide chewing are complete, and Pingyang County, the "Leather Capital of China", has sufficient supply of raw materials for leather production. The skins of cattle slaughtered on farms are sold directly or through traders to tanneries. The tanneries divide the raw hides and leave the first layer of skin and the second layer of skin that can be used for tanning, and the remaining second and third layers of skin. Wet skins are sold to pet food manufacturers or dry skin processing companies. Among them, dry skin processing companies wash, dry and sort the wet skins to obtain dry skins, which can be sold to pet food manufacturers. Pingyang County, my country's main leather processing place, has sufficient supply of leather production raw materials. With obvious raw material and production cost advantages, it has established a world-renowned pet chew food production base and local specialty industry. Pingyang County has won three "national" gold business cards: "China's Pet Products Export Base", "National Export Pet Food Quality and Safety Demonstration Zone" and "National Foreign Trade Transformation and Upgrading Base".

2.2.2 The pet oral care trend is on the rise, and the gum chewing market is ushering in new opportunities

Pet oral safety is crucial, and good chewing habits can effectively prevent oral diseases. According to the American Veterinary Medical Association (AVMA), oral health is one of the top three concerns of pet owners, with approximately 80 percent of dogs suffering from some form of oral disease by the age of three. The oral cavity is the weakest part of a pet's body. Food residues can easily breed and bacteria can infect the oral mucosa. Strengthening teeth and keeping the oral cavity clean are important issues in the prevention of pet oral diseases. Foreign experimental data show that pets’ chewing behavior plays an important role in cleaning teeth and exercising chewing power. Plaque and calculus levels are lower when pets eat chewable food than when they eat non-chewable food. It can be seen that good chewing habits can effectively reduce dental plaque and dental calculus.

Professional chewing products can strengthen teeth, and the domestic chewing market has huge potential. According to research data on dog chewing behavior conducted by Petty in cooperation with university research units, before eating chewable food, the maximum bite force of teddy bear puppies was about 30 Newtons. After 30 days of experiment, its maximum bite force reached 42 Newtons, which was higher than before eating. Increased by nearly 30%, chewing function significantly improved. Data shows that the average American pet-owning family consumes 127 sticks of chewable food every year. In China, pet-owning households consume only 12 sticks of chewable food per year, less than one-tenth of that in the United States. Chewing gum is a high-frequency consumer product in developed foreign markets. As domestic pet owners become more aware of scientific and healthy pet care, chewing gum products have greater room for development.

The appreciation of US$2.3 is good for the export of pet companies. Inventory removal is coming to an end

The rise in the US dollar exchange rate has helped pet companies increase exports, and exports in August increased slightly year-on-year. The U.S. dollar exchange rate continues to rise, and the central parity rate of the U.S. dollar against the RMB has risen from 6.8 in January 2023 to about 7.2 in November 2023. The depreciation of the RMB exchange rate will benefit export-focused companies to a certain extent. According to the General Administration of Customs, China's retail packaged pet food exports in October were 725 million yuan, -9.6% month-on-month and +18.73% year-on-year. Currently, the elimination of overseas inventories is nearing completion, and pet food companies’ overseas business has reached an inflection point. We are optimistic that corporate performance will continue to improve.

3 One-body and two-wing business strategy, two-wheel drive at home and abroad

3.1 The ODM model is stable and focuses on overseas segments

The business model of enterprises in the pet food industry Generally, it can be divided into Original Manufacturer (OEM), Original Design Manufacturer (ODM) and Original Brand Manufacturer (OBM). Most enterprises in my country mainly adopt the OEM model; some production enterprises with certain product R&D and design capabilities are gradually realizing From OEM manufacturers to ODM manufacturers, some advantageous companies have gradually begun to expand to the OBM model. According to the characteristics of the sales market, Petty adopts different sales models for foreign markets and domestic markets.

The company's overseas operations mainly rely on the ODM model, and ODM products are the company's main source of profit. Due to the relative concentration of well-known terminal sellers in the pet food industry and the obvious trend of integration of related companies, in developed countries and regions such as Europe and the United States, there are many relatively mature pet food market giants, and the marketing costs and risks of new brands are relatively high. Therefore, the company's overseas Marketing and sales mainly adopt the ODM model. From 2014 to 2016, the proportion of ODM in export sales remained stable at more than 95%.

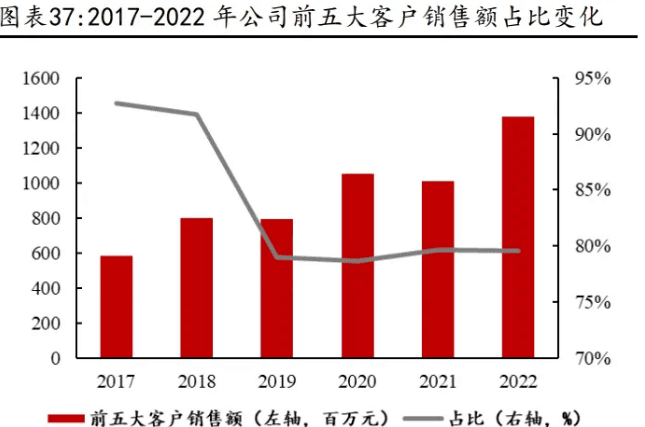

Most of the company’s ODM customers are internationally renowned pet product brands. The concentration of the top five customers is relatively high, and their proportion has declined in recent years. The company's products sold abroad are mainly OEM (ODM) products, and it has established good business cooperation relationships with leading foreign consumer goods companies such as Pedigree and Wal-Mart. The main OEM brands include Dingo and globally renowned pet chew brands such as SmartBones and DreamBone. In recent years, Petty has used new products to increase the stickiness of major customers through continuous innovation and research and development. As major customers' trust in the company's brand increases, the sales amount of the top five customers will increase from 586 million yuan in 2017 to 1.379 billion yuan in 2022, with a CAGR of 18.7%. At the same time, the company intends to explore new markets and new customers. The proportion of the top five customers has dropped from 93% in 2017 to about 80% in 2022.

3.2 Continue to develop the domestic OBM model, and the three major independent brands strive to be the first

3.2.1 The brand differentiation advantage is outstanding and the sales performance is outstanding

Pei Ti currently owns domestic and foreign brands such as ChewNergy, Meatyway, Healthguard, SmartBalance, Smartbone, and Tastybone. Among them, Jueyan, Haoshijia and Zhineng are the three major brands that focus on development. Jueyan is mainly positioned in the mid-to-high-end nutritious meat snack market segment, Haoshijia brand is positioned as a mid-to-high-end pet food brand with precision nutrition, and Zhineng brand is mainly positioned in the field of pet oral health and health care.

Jueyan is positioned as a mid-to-high-end nutritious meat snack product brand, and its natural formula is in line with the concept of scientific pet care. As pet owners pay more and more attention to pet health, food healthiness, product quality and suitability have become their primary criteria for choosing pet food. As a mid-to-high-end nutritious meat snack product brand owned by Petty, Jueyan has diverse and comprehensive product forms. The formula uses fresh natural ingredients. The raw meat has simple ingredients and does not add plant protein, starch and other ingredients. In the field of dog snacks, the main distinction between jerky products lies in whether the formula adopts a pure meat formula, and whether ingredients such as plant protein and starch are added to help it taste and shape. Jueyan brand chicken breast jerky and duck jerky stand out for their pure meat ingredients and have high quality assurance.

Jueyan leads Petty’s private label revenue list, and its single product, duck jerky, has become a hit. Jueyan currently has the largest revenue among Petty’s own brands. At the same time, Jueyan has created a hit item in the field of dog snacks with relatively homogeneous product ingredients - air-dried duck jerky snacks. In the second half of 2022, Jueyan will launch new items and categories such as chicken jerky and canned wet food. The market The response has been good and it is expected that the volume will continue to increase in the future. During the Double Eleven period in 2023, Jueyan's total network sales exceeded 25 million yuan, reaching a new high, an increase of 65% compared to this year's 618, and an increase of 67% compared to last year's Double Eleven.

Haoshijia adheres to precision nutrition and unlocks a new trend of human-pet interaction. Haoshijia's product categories mainly include wet food, new staple food and snacks. Wet food products mainly include 98k low-fat canned staple food, growing cans, gold cans, mackerel cans and other wet food categories. Dry food products mainly include cat fresh food and new rainbow recipe baked food. Among them, the 98k series of cans mainly adopts a formula with 98% meat content (after removing water), 0% glue, 0% grains, and 0% offal. It has top nutrition while also taking into account super palatability and high-quality appearance. Packaging enhances the fun and interactivity of people and pets; Haoshijia Gold Can is the first staple food brand in China to use the key indicator of pet health "Ω6/3 ratio" as a product quality control standard, aiming at the fragile gastrointestinal tract that cats may have on a daily basis , chronic inflammation, non-seasonal hair loss and other problems, it has achieved the golden ratio of Ω6/3≤5/1, and won the gold medal in the staple food category at the "3rd China Pet Industry Development Conference"; Haoshijia Rainbow Recipe Baking The food uses variable temperature baking technology to retain more nutrients, and adds a rainbow of trace elements to protect the cat.

Tooth can focus on age-specific oral care for pets, and its professional quality is worthy of the trust of pet lovers. As the world's first age-specific oral care brand for pets, Teeth Energy has been favored by users since its launch. Petty and experts from overseas laboratories conducted research and development based on the dental conditions of dogs of different ages. After repeated testing and demonstration, they developed tooth structures that fit pets of different ages, with differences in shape, hardness, nutrition, digestion, etc. Chewable products truly achieve scientific chewing and empower pets’ oral health. The current products mainly include Zhineng No. 1, No. 2, No. 3 and Zhineng snack series.

Petti’s chewing technology has reached the forefront of the world, and its chewing products are constantly iteratively upgraded. The first generation of Petty Dog Chews only used cowhide as raw material. Later, the second and third generations gradually added nutritious real meat and plant protein. The fourth generation added leather fiber and nutritional elements. The fifth generation even used animal fiber and Combined with plant fibers. Petty's chew products are developed, innovated and accumulated from various aspects such as functionality, nutrition and comfort, and the categories range from animal skin chews to plant chews. At present, the company's pet chewing food has been upgraded to the fifth generation level. On the premise of satisfying chewing and cleaning teeth, it is not only easier to digest, but also can meet the health needs of pet dogs by adding different nutrients. While the world's general technology level is still stuck in the third generation, it has achieved the advanced and differentiated advantages of the two generations. In the future, Petty will be more stable in solving oral problems for pet dogs.

3.2.2 Online and offline omni-channel layout, online channels are growing faster

Petti adopts the strategy of online and offline omni-channel layout. The company adopts a multi-channel sales strategy online. Among them, the first-level channels rely on traditional e-commerce platforms such as Tmall and JD.com for layout. Each brand flagship store cooperates with its own specialty stores and online distribution to achieve sales targets; the second-level channels focus on Douyin, Xiaohongshu, official accounts, and WeChat. The core of the layout of platforms such as Bo is to build a brand user traffic pool, improve the user operation system, and complete the direct and efficient conversion of brand users. In terms of offline sales, the company has established close cooperative relationships with regional agents and wholesalers in major provinces and cities across the country. It adopts a dealer strategy of divided channels and flat structure to radiate products to large shopping malls and terminal stores; at the same time, it also cooperates with pet Hospital chains or pet supermarkets have established independent direct supply cooperation. In addition, the company has implemented an offline distribution model with parallel direct sales and agents in Beijing, Shanghai, Hangzhou and other places. Strengthen diversified marketing strategies, and online channels grow rapidly. According to statistics from Mojing, from 2019 to 2022, the online sales of the three major independent brands of Jueyan, Haoshijia and Ji Neng increased from 18.46 million yuan to 145 million yuan. In 2022, Petty will settle in the world's first pet street "Pet Here", relying on high-quality offline display and trial experience platforms to more directly and quickly understand consumers' feedback and actual needs; in 2023, the company will sponsor a pet love comedy movie , product influence further expanded.

3.3 Actively promote the layout of production capacity at home and abroad, and continue to release new production capacity

Petit Co., Ltd. is headquartered in China and has established production bases in Wenzhou, Taizhou, Vietnam, Cambodia and New Zealand. The Vietnam base is Petty’s first stop overseas and is currently the most important place for production capacity export. Affected by the overseas new crown epidemic, Vietnam's factories temporarily suspended operations from August to October 2021, and gradually resumed production in late October. Currently, the production capacity of Vietnam's factories has been restored and is at full production, with a total production capacity of approximately 15,000 tons. Vietnamese factories are mature in operation and have great cost advantages. They are still the main source of profits. In 2022, the three factories in Vietnam achieved a total net profit of 147 million yuan. The production capacity of the Cambodian base is in the climbing stage, and t

扫一扫微信交流

扫一扫微信交流

发布评论